Add a Security System

“You can usually get discounts of at least five percent for a smoke detector, burglar alarm or dead-bolt locks,” Holeman says. “Some companies offer to cut your premium by as much as 15 or 20 percent if you install a sophisticated sprinkler system and a fire and burglar alarm that rings at the police, fire or other monitoring stations.” However, the more sophisticated systems can cost from $1,500 to $2,500 to install, plus monthly monitoring fees. “Find out what kind your insurer recommends and how much you’d save on premiums,” Holeman advises.

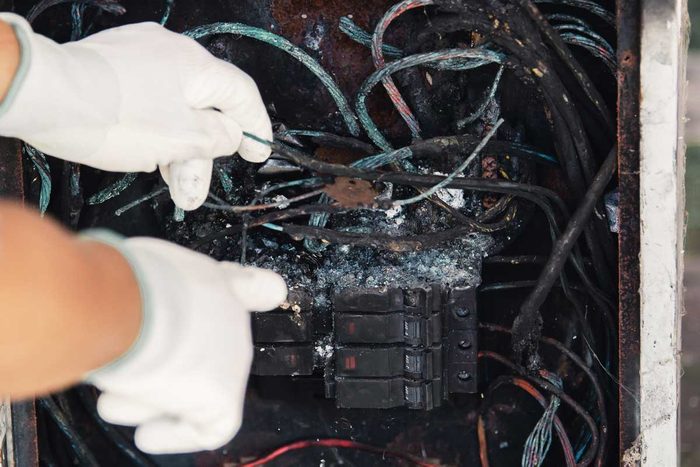

Upgrade Electrical Wiring

Outdated wiring systems have a higher fire risk, and this risk is passed onto you in the form of higher insurance premiums. Updating your home’s electrical panel or replacing aluminum wiring with modern copper wiring are both great ways to minimize that risk and lower premiums. “Upgraded systems can be viewed positively by insurance companies and potentially result in a discount,” Holeman says. Project costs will vary, but plan to spend $4 to $12 per square foot to have your home rewired and $2,000 to $10,000 to upgrade your panel.

Upgrade Plumbing Systems

“Upgrading plumbing systems can potentially save on homeowners insurance premiums by reducing the risk of water damage, which are major sources of claims,” Holeman says. Projects like replacing old water heaters, shut-off valves and fixtures like toilets and faucets count as upgrades that reduce the risk of leaks. Also, replacing aging supply and drain lines with modern materials can lead to additional savings. Expect to pay around $2,000 for a new hot water tank, while the costs to repipe your home will depend on the size and age of the home.

Update HVAC Systems

Outdated boilers and furnaces are more likely to break down and cause secondary issues like freezing pipes or fires, leading to insurance claims. “We like HVAC systems to be 10 years or younger because they pose less risk,” Beatty says. “Updating your system can lead to lower rates.” Switching from oil heat to natural gas or electric is another home project that can lower insurance costs. Plan to spend an average of $6,000 to $13,000 to update any part of your HVAC system.

Roof Maintenance

A roof in poor condition can not only lead to higher insurance rates, but can also cause you to lose or be denied coverage. I’ve been denied coverage for a few small sections of moss on my roof before, so I can attest that it does pay to keep things maintained. “Schedule regular roof inspections for any signs of damage such as leaks, missing shingles or sagging areas,” Holeman says, and have these promptly repaired. “Timely interventions can prevent minor issues from escalating into major repairs or replacements,” he adds.

Roof Replacement

Insurance companies like well-maintained roofs, but they like brand-new roofs even better. “It used to be that a twenty-year roof was our maximum age for coverage,” Beatty says, “but now we like to see ones that are 15 years or younger.” Expect to pay at least $10,000 to replace an asphalt shingle roof, but you should see your insurance rates go down when it’s finished. “I have seen an updated roof lower a customer’s rate by $700 a year,” Beatty says.

Upgrade Fire Protection Systems

Houses also run the risk of fire damage from within the home due to malfunctioning electrical systems or human error. You may receive a reduction on your home insurance costs if you have comprehensive fire prevention technology in your home. “Insurance companies often assess risk factors when determining rates, and modern systems signal a lower likelihood of costly incidents,” Holeman says. He recommends installing smoke detectors in all rooms, adding easily accessible fire extinguishers and upgrading wiring or electrical systems, especially in older homes.

Install Weather-Proof Materials

Besides wildfires, many areas of the country also contend with hurricanes, tornadoes and floods, all of which can drastically increase insurance rates. To mitigate your risk and potentially lower your rates, consider Holeman’s suggestions: “Install storm shutters or impact-resistant windows, reinforce the roof with hurricane straps or wind-rated materials, elevate HVAC systems in flood-prone areas and use hail-resistant roofing materials.” Costs will vary widely for these projects.

Add Smart Home Technology

Insurance companies really like it when you add smart technology detection systems to your home that can quickly alert you to any issues. Beatty points to features like water leak detection, smart door locks, gas leak detection or freezing pipe detection as smart home technologies that can lead to home insurance discounts. “Talk with your insurance professional about what discounts might be available by making these upgrades,” Holeman says. Costs will vary, but should range in the $300 to $700 range for each system installation.

Wildfire Mitigation Projects

If you live in an area that has a high risk of wildfires, you’re likely faced with escalating insurance costs. To help mitigate these, consider home projects that will reduce risks. “Wildfire mitigation measures, like creating defensible spaces and home hardening, can help reduce insurance costs by making your home less vulnerable to wildfire damage,” Holeman says. Other preventative measures include clearing vegetation and debris from around your home, using fire-resistant roofing materials, clearing debris from your roof and sealing gaps to prevent ember entry.

Remove Unused Play Equipment

Insurance companies refer to them as “attractive nuisances,” and the list includes trampolines, playground equipment, zip lines, diving boards and pool slides. While all of these items are admittedly fun to use and provide hours of entertainment for your kids, they also cause higher insurance premiums due to their increased risk of personal injury. If your children no longer use these items, remove them from your property for potential rate reductions. “There are additional charges for these, so you should let your insurance company know if you get rid of them,” Beatty says.

About the Experts

- Scott Holeman is Media Relations Director at the Insurance Information Institute, a non-profit organization that aims to provide insurance information to the public.

- Anne Beatty is a licensed insurance agent in the state of Connecticut. She has over twenty years of industry experience.

The post 11 Projects That Can Lower Your Home Insurance Rates appeared first on Family Handyman.

Article source here: 11 Projects That Can Lower Your Home Insurance Rates

No comments:

Post a Comment